Wireless Evolution & The Road Ahead.

It started with discovery of radio waves which soon led to Telegraph and eventually to Mobile Telephony. The very first generation of Cellular network was introduced in the late 70s with fully implemented standards being established through out the 80s. The radio signals used were 1G and were analog .

The second generation 2G digital cellular system followed 1G analog cellular system with a considerable number of advancements, as early as 90s 2G system employed the digital TDMA & CDMA which was incorporated by U.S and China but Europe adopted GSM technologies which were than incorporated by India and in most of Asia .The most widely used 2G ie GSM broadcasts data at 9.6 kbps and is used in 900 & 1800 MHZs, 2G was followed by 2.5G or edge due to ever increasing subscriber base which couldn’t be catered by existing technology, thus 2G augmented to 2.5G with the introduction of new nodes in the core networks that supported the packet data services ie 2.5G & it included GPRS technology with the data speed upgraded to 53.6 Kbps & which further could be enhanced up to 384 kbps (Indoor), 3G started with a view to provide subscriber with a high rate of Voice & Data along with network security & reliability the speeds in 3G were raised to 2048 Kbps.

The convergence of internet & wireless communication accompanied by massive growth in number of subscribers has led mobility management to eventually emerge as significant and challenging domain for wireless operators , this technology was first perfected and tested by NTT Docomo of Japan, at present there are 2 families of standards that fit in 4G technology LTE & WIMAX and is used by a large no of operators.

Evolution of Wireless Telephony In India:

Indian telecom entered the wireless age in 1995 , with first wireless call between Kolkata & New Delhi over mobile telecom network set up by Modi- Telstra . India started its journey on a 2G network & rapidly transitioned to 2.5 G than 3G in 2008 and after 4 years in 2012 Indias first 4G service was launched by Airtel in Kolkata ,Steep fall in mobile tariffs over the years has led to mobile boom . Presently the country is working on a policy to roll out 5G services.

The evolution of wireless technology over the years has changed the way Indians communicate ,it has in fact given us an distinction of being the most talkative tribe in the world . Indians started their communication journey via 2G enabled phone calls and messaging , India got its very first taste of luxury in the form of Hello Tunes on 2.5G or EDGE enabled networks in 2004 and than MMS in 2005 , later in 2008 3G enabled internet over mobile followed by first 4G service by Airtel in Kolkatta, it not only reduced the latency but provided faster speeds which allowed video streaming possible on mobile phones. The latest technology 5G will not only enable faster speeds but also will have applications in I.O.T & Machine to Machine areas.

A Decade To Remember( 2010-2020)

The years starting from 2009 witnessed a mad rush of telecom operators vying for a share of the fastest growing wireless market in the world, a sector which has always been a has followed a Duopoly trend world wide was witnessing a hyper completion in Indian skies ,there were 12 players in the market who were heating up the market by bringing not only innovative services but also reducing the tariffs so much that eventually led to their ouster .

As we can clearly witness that ARPU of the operators which was below the threshold level ultimately led to their ouster , The companies like Uninor, Videocon , Reliance , Aircel who were working on wafer thin margins were forced out of completion. Airtel , Idea and Vodafone were the only operators who were maintaining a healthy ARPU thats the reason we are seeing them competing today.

5th September 2016

This will be remembered as a watershed moment for Indian wireless telephony for good and bad reasons , This was the day when Indian wireless market witnessed the entry of Reliance Jio .It changed the dynamics of Telecom Industry , it shook up the entire market and brought in a unique monopolistic way of doing business, in fact it woke up the existing players from the slumber where they were still making money from voice whereas the world was witnessing a trend which was quite opposite

• Ultra Cheap Data : Before the entry of Jio consumers had to shell Rs 250 -450 per GB , Jio disrupted the market with a tariff as low as Rs 10 per GB.

• Online Content: India saw an exceptional rise in consumption of online content with availability of free data , it claims Indian consumption of data from 20 Crore GB to 120 Crore GB went up in six months

• Death Of 3G: While 4G was still in infancy or was a buzzword Jio rolled out its services on 4G signalling the end of the road for 3G services

.Free Voice: It marked an end to the economics of charging for every second of the voice call.

The market share in Indian market has seen a complete reversal from 2012 with market now far away from Hyper completion and is moving towards a duopoly regime with market share being controlled mainly by 3 companies which in near future may further consolidate to 2.

Future of Wireless Technology

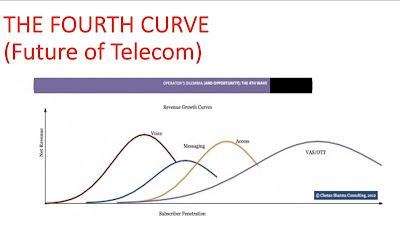

For much of the last 3 decades voice dominated the revenues streams for almost all operators however in 2013 the global voice revenues fell below the 60 % threshold , so far the drop in revenues was compensated by the rise of messaging revenues and data access revenues, the sigmoid or the S- curve has been well understood and applied to various disciplines. If we segment the operators revenues by Voice, VAS and access and correlate them with subscription growth , in most cases , as the penetration reaches 90 percent band in a given revenue stream, revenue hits a peak, stagnates for a bit and than declines . The first two curves have already declined in most of the world .

The third revenue curve of data access is in growth mode around the world ; however margin pressure on this revenue base is the strongest of the three to meet the growing data demand which is growing in every market and is expected to peak

The fourth curve is quite different from the previous three, it primarily consists of VAS and OTT services such as VoIP, Cloud, mHealth, Telematics, Advertising, payments, commerce etc. As such the fourth curve is not a single curve but rather a combination of dozens of smaller curves.

the barriers to entry are low and main competitors aren’t fellow operators but well funded internet players like Google , geotag, Paypal, Twitter , Spotify.

The business model is less about metered access and more about value creation, the growth in this 4th curve will be critical and for some operators it will be fatal and will move them away from competition .

Based on the strategy chosen , the operator will fall in 3 major buckets : access only, enabler and a digital lifestyle solution provider. To be san effective and a long term competitor on the fourth curve , operators have to become OTT players themselves. This requires innovation , financial muscles and a ruthless mindset to capture its share from the value chain. The operator might play all the three roles on a given vertical, however without playing a significant role in the later two categories the margins will shrink from 25-30 % to 8-12. As operators ability to recognise the importance of the fourth curve will pretty much define its role in the ecosystem.

Comments

Post a Comment